Please Donate & Get involved

How Can You HelpWe fully depend on your help to feed and maintain our herd and further our mission.

Please kindly help us

Food For the herd

Gau Bhojan Seva

Sponsor Feast

One day feast for the herd- Please kindly sponsor a treat for herd.

- We shall feed the cows seasonal fruits and vegetables.

- Seasonal fruits include Watermelon, Banannas etc.

- Seasonal vegetables include Carrots, tomatoes etc.

- We shall send photos of feast upon request to your whatsapp or email.

Sponsor Grass & feast

One day Grass & Feast for the herd- Please kindly sponsor green corn grass for a day. Also add a treat for the herd.

- We shall feed freshly cut corn grass topped with seasonal fruits and vegetables in your name thrice on your chosen date of sponsorship.

- You can choose to sponsor on birthdays / Anniversaries / in the name of departed souls or to simply please cows.

- We shall do a Maha-sankalpa & Gau-Poja on your name for the well being of your family.

- We shall upload the video of feeding on our social handles.

Sponsor Grass

One day Grass for the herd- We shall send photos of feast upon request.Please kindly sponsor green corn grass for a day.

- We shall feed freshly cut corn grass in your name thrice on your chosen date of sponsorship.

- You can choose to sponsor on birthdays / Anniversaries / in the name of departed souls or to simply please cows.

- We shall do a Maha-sankalpa & Gau-Poja on your name for the well being of your family.

- We shall send photos of feeding upon request to your whatsapp or email.

Seva for a cow

Gau Seva

Medical Expenses

for one sick cow for a month- Many of our cows have injuries sustained due to their unfortunate experiences in slaughter houses and in their previous owners place.

- Such cows require daily and delicate medical and personal care. This is a costly affair and we require your help.

- A Maha-Sankalpa would be performed in your name.

Adopt a cow

by taking care of its basic needs for a year- It would take INR 125 per day to meet its basic needs. When you take care of this expense for a year you adopt that cow.

- You can name the cow and we would be uploading its picture in our social media regularly.

Save a cow ( Gaudhan)

from slaughter- With your help we can save cows from slaughter by purchasing them from butchers.

- After that we would help the cow recuperate by giving it proper nutritional, medical and personal care.

- We would be performing a Gau Dhan Puja on your name.

- We shall upload the photos of cows rescued by you in our social media handles.

Other Sevas

Gau Poshan Seva

Sponsor Gaupalak

by paying his salary for a month- Please help us pay salary for the Gau Palak ( the one who takes care of the cows needs). This would help us provide a better care for the cows.

Monthly Feast

for ayear- Please kindly sponsor a treat for herd on your star every month for a year.

- We shall feed the cows seasonal fruits and vegetables on your star every month.

- Seasonal fruits & vegetables include Watermelon, Carrots, tomatoes etc.

- Over the course of the year, we’ll post three videos in our social media handles. This seva will be offered to the cows at noon.

- Photos of monthly feast shall be shared upon request via WhatsApp or email.

Fodder Farmaing

on 1 acre land- Please kindly help us cultivate fodder grass in 1 acre land.

Also you can do a general donation of any amount

Please let us know about your donation

80(G) Tax Exemptions

Dakshin Vrindavan is a registered Charitable Institution under Indian Trust Act. Donations made to the trust are eligible for exemptions u/s 80(G) of Income Tax Act 1961

FCRA Permit

Dakshin Vrindavan is registered under Section 11 (1) of Foreign Contribution (Regulation) Act, 2010 by Ministry of Home Affairs. As such eligible to receive donations from Non Indian Bank Accounts. The donation has to be made to our Exclusive FCRA account and NOT to regular current account. This donation is also eligible for exemptions u/s 80(G) of Income Tax Act 1961

501 (C) (3) Exemptions

Dakshin Vrindavan US Inc. is registered in Florida as Not for profit Corporation. Donations to Dakshin Vrindavan US Inc is exempted from federal income tax under IRC section 501 (C) (3)

Matching Donations by your company

Many companies in USA have matching programs for registered charities. As a registered 501(c)(3) organization, Dakshin Vrindavan US Inc is eligible to receive matching contributions. If you are making a donation with us, please kindly check with your employer if matching donations are supported. This would be of great help as it would facilitate rescue of more cows from slaughter.

It would help us if you would

Kindly Let Us Know

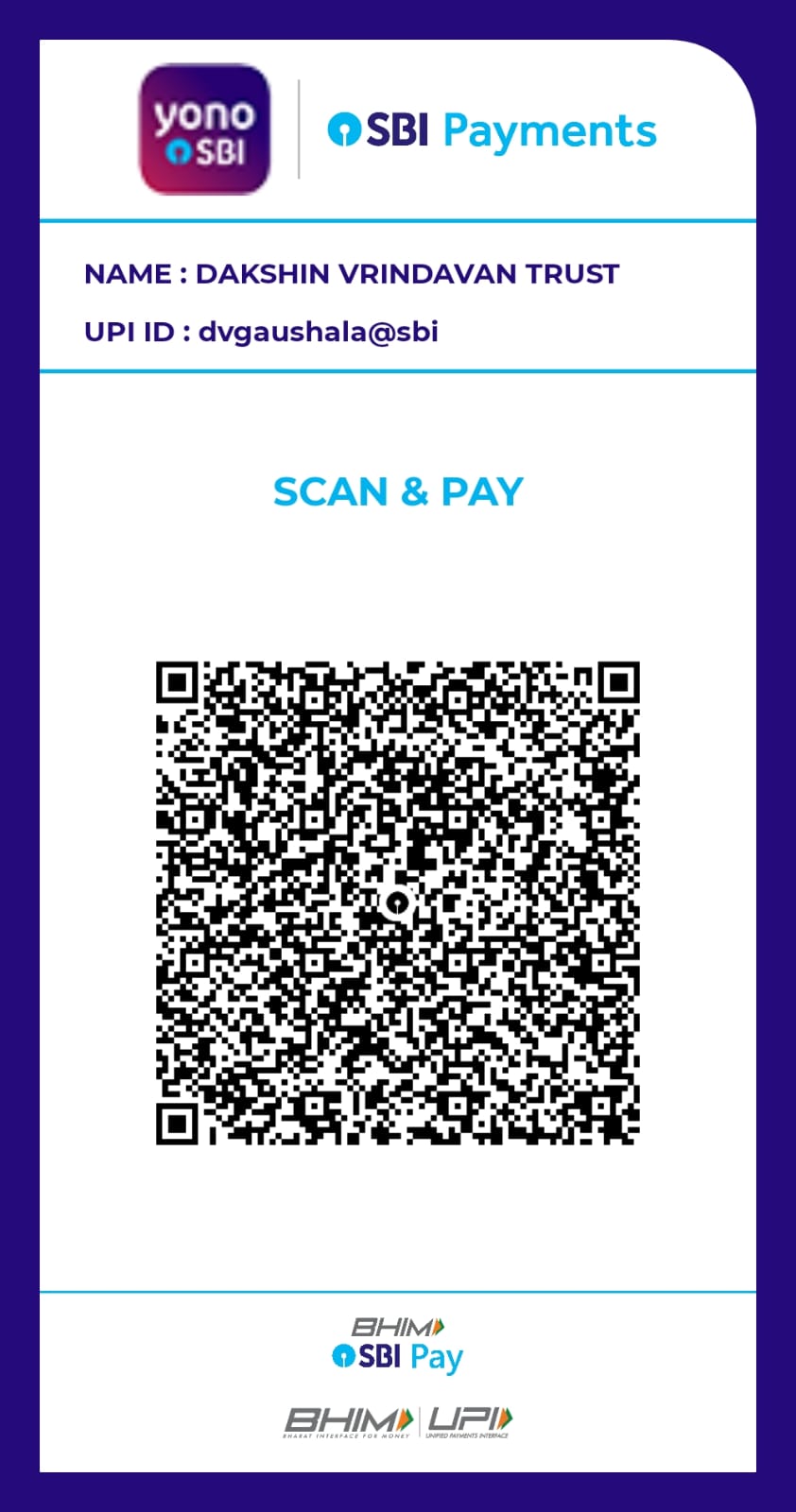

Here is how you can donate

From Bank Accounts In India

You can do an Account Transter

Our SBI Bank Details

A/C Name : DAKSHIN VRINDAVAN TRUST

A/C Number : 37645565329

IFSC CODE : SBIN0040197

BRANCH : RAJAJINAGAR

(Current Account)

You can do an UPI Transfer

dvgaushala@sbi

You can send us a cheque

Favouring “Dakshin Vrindavan Trust”

and send to

Ashwin Sampatkumar, Dakshin Vrindavan Trust, 1339/67A, Chetan Nilaya, 1st Floor, 5th Main Road, E Block, Rajaji Nagar 2nd Stage, Bangalore, Karnataka, India – 560010

Indian Tax payers can claim exemptions under 80(g) of Income Tax if donation made to Indian Bank account.

Here is how you can donate

From Bank Accounts in USA

You can do an Paypal Transter

You can send us a cheque

Favouring “Dakshin Vrindavan US Inc”

and send to

Deepak Shankar, 12136 167th PL NE, Redmond, WA 98052, USA

Tax Payers in USA can claim tax exemption under 501(c)(3) of Federal Tax for donations made to Dakshin Vrindavan US Inc.

Here is how you can donate

From Bank Accounts Outside India

We have FCRA Permit

Donations from Outside India Bank Accounts to our Indian Bank Account CANNOT be transferred to the regular current account.

We have an Exclusive FCRA Account for the same. To know more please kindly email / whatsapp / phone us.

Email : sampatkumar@dakshinvrindavan.org

Whatsapp / Phone : +91 80500 78977 (Founder)

Whatsapp : +91 80860 78977 (Office Staff)

Indian Tax payers can claim exemptions under 80(g) of Income Tax if donation is made to Indian FCRA account.

Please help us expand

Become A Life Member

INR Version

Click on the button below to open our INR version of the Life Membership Program.

USD Version

Click on the button below to open our USD version of the Life Membership Program.